Gold rate in Pakistan on Wednesday marked an insignificant uptick, owing to a slight increment observed in yellow metal’s prices in the international market.

The price of gold (24 carats) in Pakistan increased by Rs600 per tola and Rs514 per 10 grams to settle at Rs241,900 and Rs207,390, respectively, as per the data released by the All-Pakistan Sarafa Gems and Jewellers Association (APSGJA).

Per tola gold price in Pakistan touched an all-time high of Rs252,200 per tola on Saturday (April 20, 2024).

The association also mentioned that the price of gold is Rs4,000 per tola “undercost” in Pakistan, as compared to international market, showing that the Pakistani gold market was currently cheaper than the global.

Gold — which is considered a hedge against inflation — registered losses in the local market after a stronger-than-expected inflation data — which fell to its lowest level since May 2022 — softened expectations of a rate cut. Moreover, steady monetary policy sapped investors’ spirit.

In the similar manner as that of Pakistan's domestic market, gold price also gained $6 per ounce in the international market to settle at $2,313.

Bullion price in the international market touched a record high of $2,431.29 on April 12.

Silver prices in the domestic market remained unchanged at Rs2,750 per tola and Rs2,357.68 per10 grams, respectively.

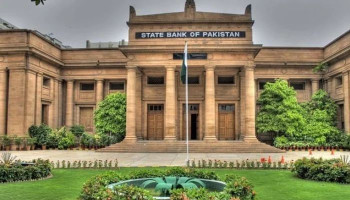

Gold price in Pakistan is announced by the association, which determines gold prices in Pakistan for local markets six days a week from Monday to Saturday.

Pakistan is a small market for gold at the global level. It meets the commodity’s demand through imports as it does not produce the precious metal locally.

Accordingly, the gold rate in Pakistan is determined by keeping in view its prices in world markets, rupee-dollar exchange rate, and demand and supply in domestic markets. The latest price for local markets was determined to keep in view the prices at which trade took place among buyers and sellers.

Gold price in Pakistan has been volatile in Pakistan recently amid continued political and economic uncertainty and high inflation. People prefer to buy this precious commodity in such times as a safe investment and a hedge.