An undated image of a stack of prize bonds. — Online

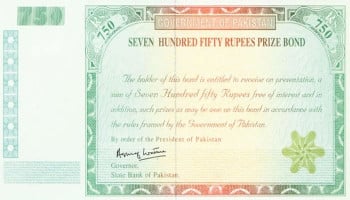

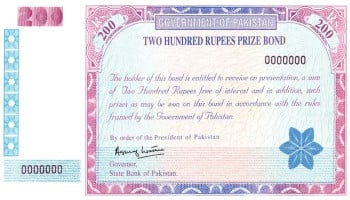

In Pakistan, prize bonds are available in six different denominations Rs100, Rs200, Rs750, Rs1,500, Rs25,000, and Rs40,000.

The Government of Pakistan continues to provide prize bonds as a prominent savings instrument as these bonds are sold at designated branches of the State Bank of Pakistan (SBP) and National Savings Centres across the country.

Prize bonds offer an opportunity for holders to win major cash prizes through regular draws held throughout the year. The bonds are bearer instruments, meaning they do not carry the holder's name, ensuring anonymity. This scheme is a preferred choice for many investors looking for a secure and accessible form of investment with the added excitement of lottery-style winnings.

If you own a prize bond and are concerned about the tax deducted on prize money in Pakistan then Gadinsider has got you covered.

Is tax deducted on prize money in Pakistan?

The Prize bond draw is conducted by a committee constituted by the Central Directorate of National Savings (CDNS) and is open to the general public.

Winning prize bonds are drawn through the Hand Operated Draw Machine, operated by special children in front of committee members and the general public attending the draw ceremony. The draw machine is also checked by the general public before the start of the draw.

With Holding Tax (WHT) on prize money is deducted under Section 156 of the Income Tax Ordinance 2001. The current rates of tax deducted are 15% for filers and 30% for persons not appearing in the Active Taxpayers List, irrespective of the date of draw.