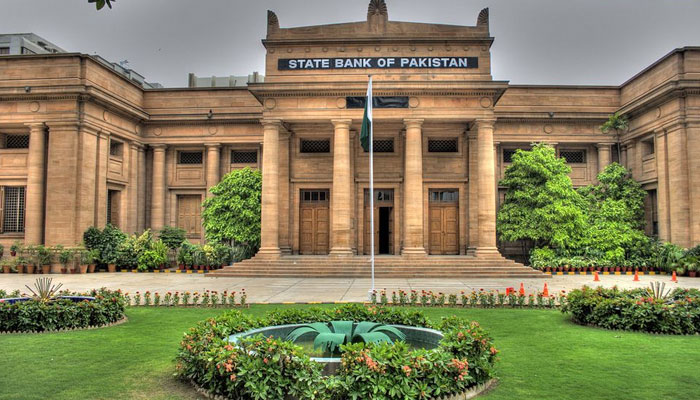

In line with experts’ anticipation, the State Bank of Pakistan (SBP) on Monday decided to leave its key interest rate unchanged at 22% for the fifth consecutive time in the past nine months.

“The [Monetary Policy Committee] MPC noted that despite the sharp decline in February, inflation remains at elevated level. The inflation outlook is also susceptible to risks amidst elevated inflation expectations,” the central bank said in a thread shared on X (formerly Twitter).

It should be noted that according to traditional practice, the central bank revises its monetary policy rate up or down or keeps it unchanged over the inflation reading and economic activities.

For example, low inflation mainly leads to a reduction in the monetary policy rate to ramp up economic activities and vice versa. Meanwhile, the rate is left unchanged at a higher level to tame inflation or on the lower side to support economic growth.

The SBP, in its Monetary Policy Statement issued after the meeting, noted that the trajectory of inflation warrants a cautious approach and requires continuity of the current monetary stance to bring inflation down to the target range of 5 – 7% by September 2025.

“The Committee reiterated that this assessment is also contingent upon continued targeted fiscal consolidation and timely realization of planned external inflows,” the statement read.

Since its last meeting, the MPC noted some key development which include:

- First, the latest data continues to depict moderate pick-up in economic activity, led by rebound in agriculture output.

- Second, the external current account balance is turning out better than anticipated and has helped maintain foreign exchange buffers despite weak financial inflows.

- Third, while inflation expectations of businesses have shown a steady increase since December, those for consumers have also inched up in March.

- Lastly, on the global front, while the broader trend in commodity prices remained benign, oil prices have increased; partly reflecting the continued tense situation in the Red Sea.

Outlook

The MPC assessed that the current account deficit is likely to remain closer to the lower bound of 0.5 to 1.5% of GDP forecast range for FY24, which will support the foreign exchange reserves position.

"Any further adjustments in administered prices or fiscal measures that may push prices up pose risk to the near- and medium-term inflation outlook," the autonomous committee noted.