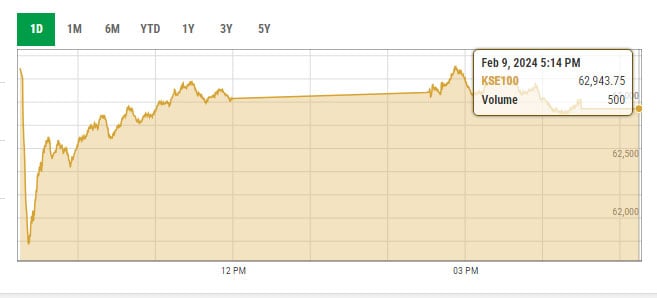

The Pakistan Stock Exchange (PSX) crashed on Friday as delay in general elections results fueled profit-taking at the bourse. The market crashed within a few minutes into trading; however, as the results of the polls trickled, investors relaxed and the market recovered slightly.

At close, the benchmark KSE-100 index settled at 62,943.74 points with a decline of 1,200.13 points, or 1.87%.

Capital market expert Muhammad Sohail said that the index initially fell over 3% due to the "unexpected" results of the elections.

It should be noted that as per the PSX Rulebook if the index goes 5% above or below its last close and stays there for five minutes, trading in all securities is halted for a specified period.

Delay in general elections results — which were held across the county a day earlier — coupled with concerns regarding the transparency of polls pushed the index deep in the red.

Major contribution to the index’s slump came from Oil and Gas Development Company, Pakistan Petroleum, Engro Corporation, Engro Fertilisers and Hub Power as they shed value, pulling the market down by 366 points, Topline added.

Arif Habib Limited (AHL), in its report, noted that the end of a shortened, but very eventful week saw the KSE-100 remain flat week-on-week.

Only eight stocks rose on Friday while 77 fell with Oil and Gas Development Co (-3.71%), Pakistan Petroleum (-3.7%) and Engro Corporation (-2.37%) being the biggest drags on the index, it said.

“Election results, which kept dominating the news flow, will be the key driver for the market next week,” it predicted.

Despite -1.9% day-on-day close following delay in election results, “price action did not break the structure and remained within the converging trend lines”, AHL added.