As back-bitting inflation shrinks the purchasing power of the masses, people are now looking for alternate means to make ends meet. So with your limited time and your nine-to-five, how can you increase your income?

Most millionaires have seven streams of income, Forbes reported, citing Yahoo Finance.

1. Earned income

This is the income you earn from your job or paid employment. You're usually trading your time and skills for money. The biggest upside to earned income is that it is usually reliable and consistent and can cover your basic living expenses or parts of it.

2. Capital gains

This is the income you receive as the profit from selling assets, such as real estate, art, or cars.

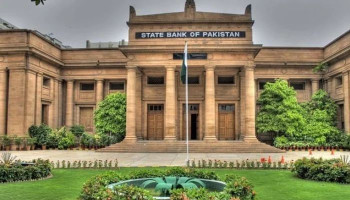

3. Interest income

A common source of supplementary income, interest is usually generated from bank accounts and bonds. However, interest income is dependent upon inflation.

4. Dividend income

This is a type of passive income you can generate by owning stocks that pay dividends. Its upside is that it is profitable and acts as a partial buffer against declining prices of assets.

5. Rental income

This is income you can generate by renting out properties such as office buildings, houses, or apartments.

6. Business income

For many people trying to maximise their income, owning a business comes in handy. There is unlimited earning potential from business income.

7. Royalty income

Intellectual property, such as trademarks, property, or patents, can help prove a reliable and steady source of income. However, how much you earn is based on monthly sales.

It's important to remember that building these streams of income takes time.

You're not going to start making money from them immediately. Moreover, another way to make money if you feel these streams of income won't cut it for you, is to try a part-time job.