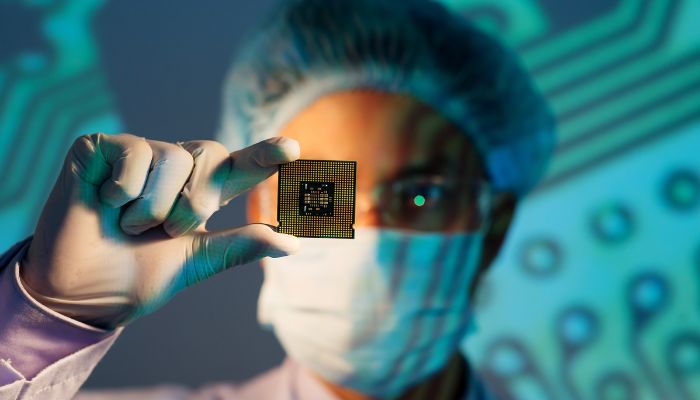

The semiconductor market in Asia/Pacific (excluding Japan and China) is expected to grow by 8.9% in 2024, reaching $104.5 billion, according to a new report by International Data Cooperation (IDC).

The report, titled Asia/Pacific Semiconductor Market Forecast, 2022-2026, provided a comprehensive analysis of the market trends, drivers, challenges, and opportunities for the semiconductor industry in the region.

Key drivers and trends

The report identified several key drivers and trends that will shape the semiconductor market in Asia/Pacific in the next four years, such as:

- The recovery from the COVID-19 pandemic and the easing of supply chain constraints have boosted the demand for semiconductors across various end-user segments, especially consumer electronics, automotive, and industrial.

- The acceleration of digital transformation and innovation will spur the adoption of emerging technologies such as 5G, artificial intelligence (AI), cloud, edge computing, and the Internet of Things (IoT), creating new opportunities for semiconductor vendors to offer differentiated solutions and services.

- The increasing geopolitical tensions and trade disputes will prompt the governments and enterprises in the region to invest in local semiconductor capabilities and ecosystems, enhancing the self-reliance and resilience of the industry.

Read more: Chinese firms look to Malaysia for assembly of high-end chips

Outlook of semiconductor market

The report also provided detailed market segmentation and outlook for the semiconductor market in Asia/Pacific by product category, application, and country. Some of the highlights include:

- Memory will remain the largest product category, accounting for 38.4% of the total semiconductor revenue in 2024, followed by logic (24.4%) and micro-components (15.9%).

- Consumer will be the largest application segment, contributing 28.9% of the total semiconductor revenue in 2024, followed by communications (26.7%) and computing (20.8%).

- India will be the fastest-growing country, with a compound annual growth rate (CAGR) of 15.6% from 2024 to 2026, driven by the expansion of the smartphone, PC, and data centre markets, as well as the government’s initiatives to promote local manufacturing and innovation.

Key recommendations

The report concluded with some key recommendations for semiconductor vendors, customers, and policymakers in the region, such as:

- Semiconductor vendors should leverage their core competencies and partnerships to offer value-added solutions and services that address the specific needs and challenges of the end-user segments and markets in the region.

- Semiconductor customers should adopt a holistic and proactive approach to managing their semiconductor sourcing and procurement, considering factors such as quality, reliability, security, and sustainability, in addition to cost and availability.

- Policymakers should foster a conducive and collaborative environment for the development and growth of the semiconductor industry in the region, providing incentives, regulations, and standards that support innovation, investment, and trade.