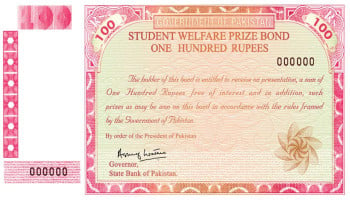

An undated image of different prize bonds. — Facebook

Prize bonds are considered a popular investment option in Pakistan, providing the chance to win substantial cash prizes while earning interest on your investment.

Prize bonds are said to be issued by the National Savings Central Directorate (NSCD) and come in different denominations — Rs100, Rs200, Rs750, Rs1500, Rs25000, and Rs40000.

If you have decided to purchase prize bonds, then buy from authorised banks or saving centres. Once you purchase a bond, it is entered into a monthly draw where numerous cash prizes are awarded.

Read more: How much tax is deducted on prize bond money?

The prize structure for prize bonds differs depending on the denomination. Higher denomination bonds typically have a higher chance of winning larger prizes. Gadinsider has compiled some of the common prizes.

- First prize: Millions of rupees

- Second prize: Hundreds of thousands of rupees

- Third prize: Tens of thousands of rupees

Is date of issue important for any prize money?

Yes, the date of issue is important for any claim of prize money in prize bonds, as only those prize bonds qualify for prize money, which have been purchased two months prior to their respective draw.